Car rental insurance is an essential consideration for any traveler planning to rent a car. If you are renting a car with Enterprise, it’s important to understand the various insurance options and requirements before picking up the rental car. Without adequate insurance, you may be held responsible for any damage to the rental car , which can result in unexpected and significant expenses.

According to Enterprise Customers are not required to purchase car rental insurance when renting from Enterprise.

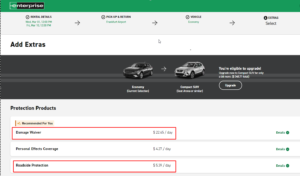

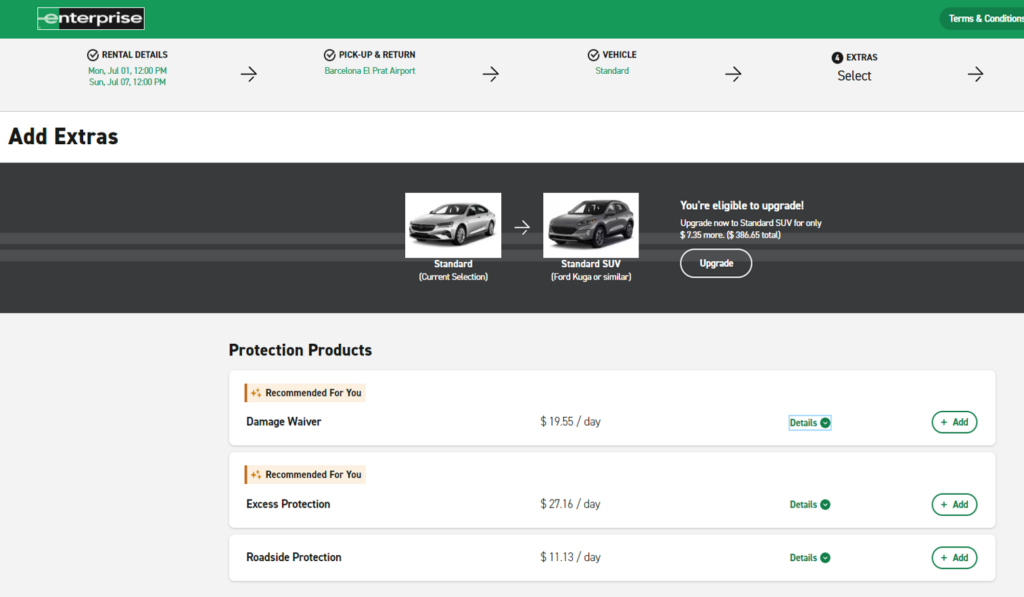

Enterprise insurance offers a variety of protection products that can be purchased in addition to renting a vehicle. These protection products include Damage Waiver, Personal Effects Coverage, Supplemental Liability Protection, and Roadside Assistance Protection. Each type of protection offers coverage for different situations, and customers can choose which protections they want to purchase based on their specific needs.

The cost of optional car rental insurance and protection products can vary depending on factors such as the type of vehicle being rented.

It is important to note that Enterprise insurance is optional, and you can decline to purchase it if you have your own insurance or prefer to assume the risk yourself. However, it is recommended that you carefully consider their options and make an informed decision about whether or not to purchase rental car insurance before renting a vehicle.

Enterprise Rental Car Insurance works by providing customers with optional protection plans that they can purchase along with their rental car to safeguard them and the vehicle in the event of a collision, theft, and more.

Understanding how much is enterprise insurance per day is important when renting a vehicle from Enterprise, as it can help you make an informed decision about whether to purchase additional protection products or rely on your existing insurance coverage.

Enterprise offers several additional protection products that customers can purchase along with their rental car, including Damage Waiver, Personal Effects Coverage, Supplemental Liability Protection, and Roadside Assistance Protection.

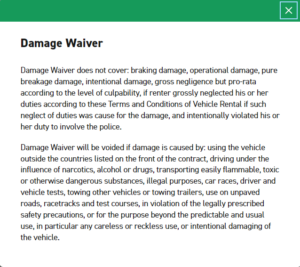

Damage Waiver (DW) is a protection product that can waive your responsibility for the cost of damage to the rental car in the event of an accident or theft. Although DW is a part of your rental agreement, there is an excess. Should something happen to your rental car, you are financially responsible for this excess. The excess amount at Enterprise for Standard and Small Passenger Vans is € 950. For Full size and Premium vehicles, Large Passenger Vans, Large SUVs and the Small Cargo Van the excess is € 1150. For all other Cargo Vans the excess is €1500, and for the Luxury Elite Electric an excess of €2500.00 applies.

Enterprise’s Damage Waiver covers the following:

Your Enterprise collision damage waiver essentially covers all damage to the car and theft of the vehicle with no costs to you or your insurance company, provided you weren’t driving in a banned manner.

Excess Protection, a package offered by Enterprise, lowers the excess for the majority of cars to €100. The daily fee for this service is US$ 22.45. It is significant to keep in mind that excess reduction fees can change according to the location and type of rental vehicle being used. For the most precise and recent information regarding excess reduction fees, it is advised to contact Enterprise directly.

Enterprise Excess Protection

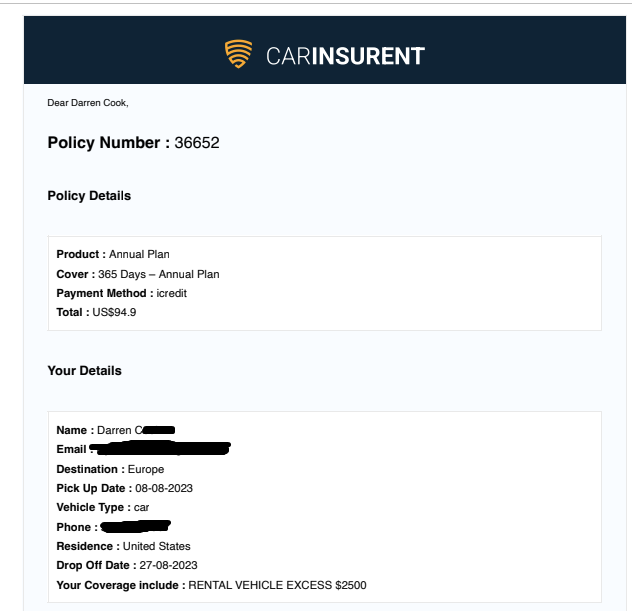

If you purchase CarInsuRent car rental insurance , the excess amount can be eliminated and reduced to zero for as low as $6.49 per day* to $94.90 for an annual policy . You will also need to provide a deposit at the time of picking the car, which is totally refundable. For the majority of vehicles, this is set at €200.

* Prices based on 10 days coverage

Personal Accident Insurance (PAI) is a protection product that can provide coverage for medical and ambulance expenses, as well as accidental death benefits, for you and your passengers in the event of an accident. Personal Effects Coverage (PEC) is offered for an additional daily charge of US$ 4.27.

Supplemental Liability Protection (SLP) is a protection product that can provide you with additional liability coverage in the event of an accident that causes damage or injury to other people or property. If the renter accepts SLP, Enterprise provides third party liability protection up to $1,000,000 (for a single third party liability claim).

Roadside Assistance Protection (RAP) is a protection product that can provide you with assistance for incidents such as lockouts, lost keys, or dead batteries. This package might lessen your financial obligation for the following: tyre and glass repair/replacement costs (apart from significant repairs), new key costs, recovery fees, and call out fees. A daily cost of US$ 5.39 may apply.

Enterprise Protection Products

See How Much You Can Save on Your Enterprise Insurance

* Prices based on 10 days coverage

Enterprise Damage Waiver Exclusions

Mr. Darren C, rented a vehicle from Enterprise in Spain. Despite declining the rental company’s insurance coverage due to its high cost, Darren decided to purchase standalone car hire excess insurance from CarInsuRent after reading about its benefits.

Copy of Mr. Darren C. Car Hire Excess Policy

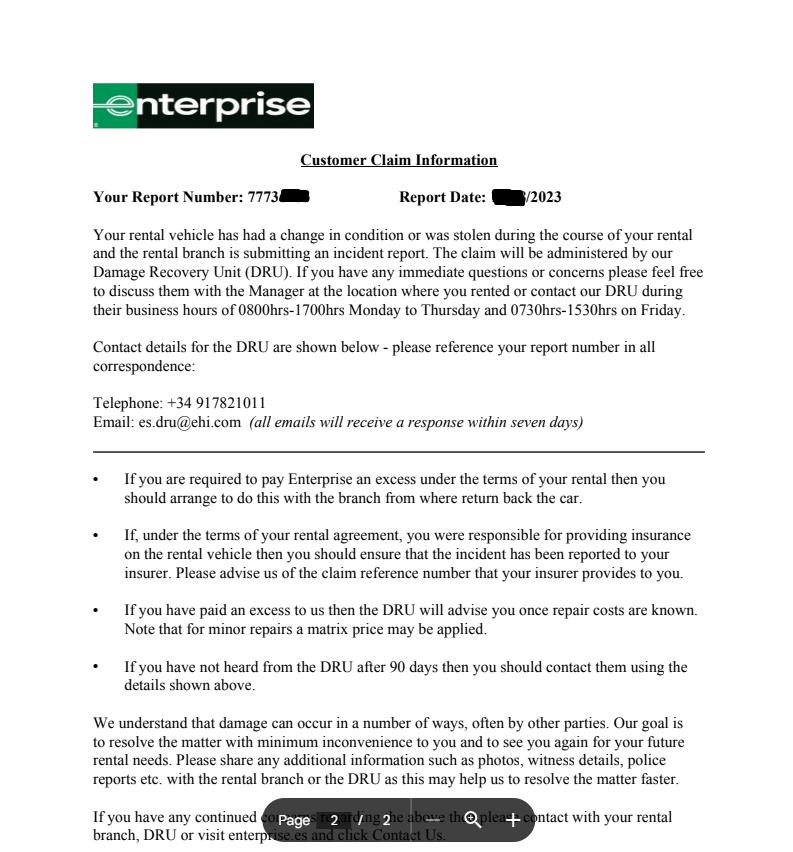

After Darren returned the rental vehicle, he received a letter from Enterprise stating that the rental car was damaged during his rental.

Enterprise Damage Recovery Unit Notification

Enterprise Damage to Rental Car

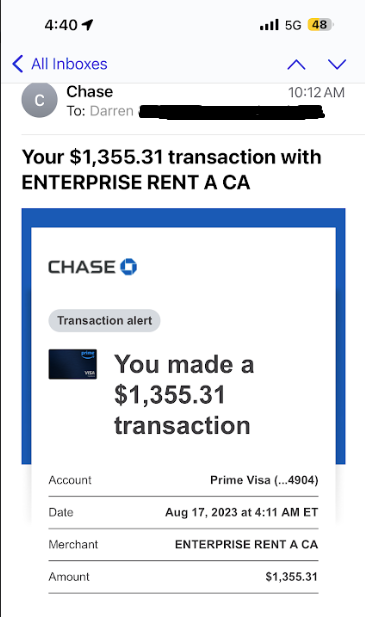

Unfortunately, Enterprise charged Darren US$ 1,355.31 for the damage.

Enterprise Damage – Repair Cost

However, Darren had purchased car hire excess insurance, which covered the excess amount he would have to pay in such situations. As a result, he was able to file a claim with CarInsuRent, and we reimbursed him for the repair costs incurred by the rental company. This saved Viktor hundreds of Euros, as he only had to pay US$ 94.90 for the car hire excess coverage instead of the full repair bill.

Excellent On Based on 126 reviews

Amazing service. always efficient, friendly, responsive. I got my payment within days of submission. Bill is warm. A pleasure to work with them. highly recommended. I feel safe with them.

By Alon Goshen-Gottstein Oct 13, 2023Car hire excess insurance for 10 days rental in Europe with CarInsuRent will cost US$64.90 compared to US$ 278.40 when purchasing the equivalent coverage from Enterprise. Total potential saving: US$ 213.50.

We compared and analyzed Super Collision Damage Waiver costs for a 7-day rental of a standard car class (July 1st – July 7th). The car rental insurance rates listed here are subject to change by the car rental companies without notice. For the most up-to-date pricing information, we encourage you to request a free online quote prior to booking.

CarInsuRent’s car hire excess protection for rental vehicles offers the same coverage at a 70% lower cost!

| Country | Collision Damage Waiver (CDW) + Theft Protection (TP) | Avg. Super Collision Damage Waiver Cost at Counter* | Avg. Insurance Deductible at Counter* | Avg. Cost for Rental Car Excess Insurance with CarInsuRent | Cost of Deductible with Zero-Excess from CarInsuRent |

| France | US$ 25.00 | US$ 23.16 | U$ 3,187 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Germany | Included at the rental price | € 32.99 | € 1,450 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Iceland | US$ 21.50 | € 44.61 | US$ 1,400 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Ireland | Included at the rental price | € 24.00 | € 2,700 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| New Zealand | Included at the rental price | NZ$ 36.47 | NZ$ 4,025 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

| Spain | Included at the rental price | € 34.47 | € 2,420 | US$ 6.49 per day or US$ 94.90 for annual coverage | $0 USD |

Enterprise Rental Car Insurance in Spain

See How Much You Can Save on Your Enterprise Insurance

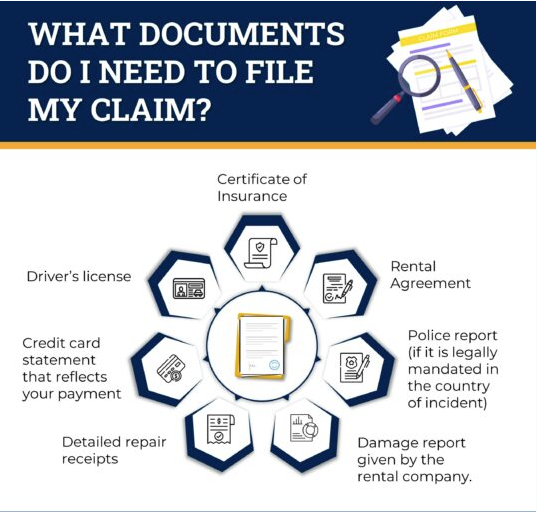

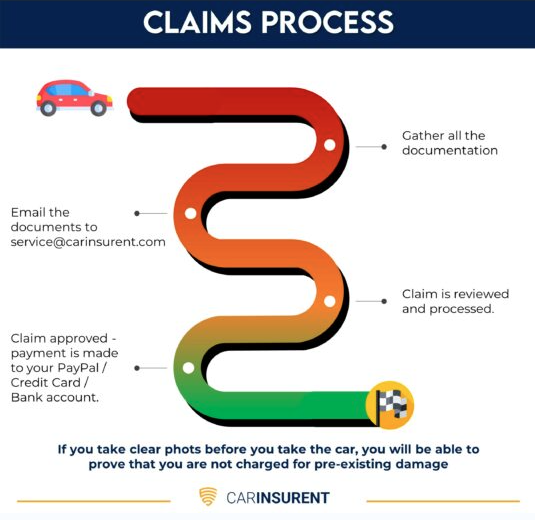

What to Do in Case of an Accident or Damage – If you are involved in an accident while driving a rental car, there are certain steps you should follow to file a claim with the rental car insurance company. First, exchange personal information with the other driver, including name, address, license plate number, rental vehicle information, insurance company, and policy number, and document the accident with pictures and notes. If the other driver is at fault, you should get their contact and insurance information and call their insurance company directly to file a claim. If you are at fault or have non-collision damage, you can file a claim with the rental car insurance company. The process for filing a claim with the rental car insurance company may vary depending on the provider, but typically, you would need to provide details of the incident, including the date, time, and location of the accident, as well as any police report numbers, if applicable. Additionally, you may need to provide documentation of the damage, such as photographs or repair estimates.

What Documents Do I Need to File My Claim?

Tips for a Smooth Claims Process: Filing an insurance claim can be a complicated and stressful process. The following tips can help ensure a smoother claims process:

By following these tips, you can help ensure a smoother claims process, and increase the chances of receiving the maximum benefit that you are entitled to under your insurance policy.

In conclusion, having car rental insurance with Enterprise is not mandatory. Enterprise offers several auto insurance products to cover your rental vehicle. While Damage Waiver (DW) is a part of your rental fee, there is an excess. You purchase Excess Protection, a package offered by Enterprise, that lowers the excess for the majority of cars to €100. The daily fee for this service is US$ 22.45.

Enterprise’s collision damage waiver can be the best option if you want the greatest level of comfort and are willing to pay for it. You can save money by shopping around and buy car rental insurance online for as low as $6.49 per day* to $94.90 for an annual policy .

Before choosing an Enterprise rental car insurance policy, you should confirm what level of coverage is included with your personal auto insurance policy or the credit card you used to reserve the vehicle. By doing this, you can avoid paying for the same coverage more than once.

Ultimately, understanding the different types of insurance available to you and making an informed decision can help you have a stress-free and affordable car rental experience with Enterprise.

See How Much You Can Save on Your Enterprise Insurance

how much is enterprise car rental insurance

what does enterprise car rental insurance cover